A Journey Through Time: The Birth of the Credit Card

The credit card, a cornerstone of modern financial transactions, traces its origins to the economic boom following World War II. Initially, the concept of credit existed in various forms, such as store credits or charge coins, but these were limited to specific merchants. The game-changer came in 1950 with the introduction of the Diners Club card, the first universal credit card. This revolutionary idea was initially intended to simplify restaurant bills but quickly expanded to other sectors. The success of Diners Club paved the way for other companies, such as American Express and Visa, to launch their credit card programs in the following years, dramatically altering the landscape of consumer spending and borrowing.

The Expansion and Evolution of Credit Cards

Credit cards underwent rapid evolution after their inception. By the 1960s and 1970s, they were becoming more than just a borrowing tool; they symbolized financial status and spending power. Financial institutions began aggressively marketing credit cards, offering a range of perks from travel insurance to reward points. This period also saw technological advancements, like the introduction of magnetic stripes, which streamlined transaction processes. However, alongside these developments, the industry faced challenges, including regulatory changes and concerns over consumer privacy and security.

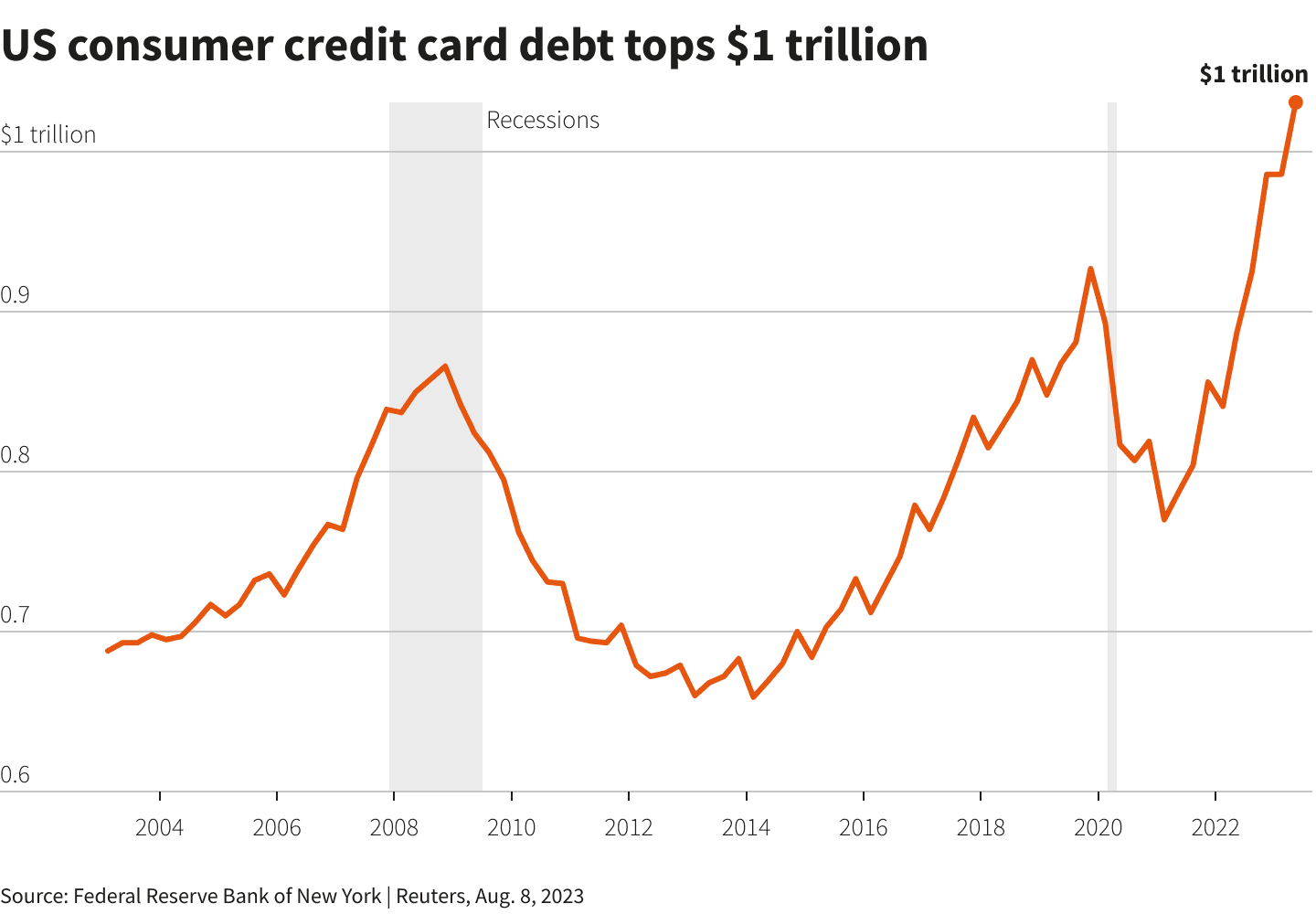

The Rising Tide of Credit Card Debt

The widespread availability and aggressive marketing of credit cards led to a surge in consumer debt, especially in the late 20th century. Credit card companies often targeted consumers with less financial experience or lower incomes, leading to a situation where many users found themselves in over their heads with debt. The ease of making minimum payments, combined with high-interest rates, resulted in ballooning balances that could take years to pay off. This trend was exacerbated by economic downturns, like the recession in the early 2000s, where credit card debt contributed significantly to financial distress for individuals and households.

Navigating Credit Responsibly

In light of the increasing debt issue, financial literacy and responsible credit card use have become more critical than ever. Understanding interest rates, fees, and the impact of only making minimum payments is essential for managing debt effectively. Additionally, consumers should be aware of how their credit card usage affects their credit score, which in turn influences their ability to secure loans, mortgages, and other financial products. Budgeting, monitoring credit card statements, and using tools like credit score simulators can help maintain healthy financial habits and avoid the pitfalls of credit card debt.

ClearCred: A Modern Solution to Credit Card Management

In today's digital age, managing credit has become more straightforward with tools like ClearCred. ClearCred consolidates all your credit cards into one convenient app. It allows you to view interest charges before they're applied, pay your statements, and importantly, helps you automatically set aside money with each purchase to pay off your balance. This not only aids in responsible credit card usage but also helps you earn interest on the money you set aside, offering an additional financial benefit.

By understanding the history and evolution of credit cards, we can appreciate this convenience while being mindful of the potential for debt. With responsible use and modern tools like ClearCred, credit cards can be a valuable part of your financial toolkit.

Disclaimer: The content provided in this article is for informational purposes only and does not constitute formal financial advice. While efforts have been made to ensure accuracy, readers are advised to conduct their own research and consult with a professional financial advisor before making any financial decisions. ClearCred is not responsible for any actions taken based on the information provided in this article.

Continue Reading

Discover more financial insights and tips

Buying vs. Renting in Today's Housing Market: Why Homeownership Prevails

In today's ever-evolving housing market, the age-old debate between buying and renting continues to challenge potential homeowners. While both options have their merits, recent data increasingly supports homeownership as a financially sound decision for many Americans.

Frank DiGiacomo

The Debt Trap No One Talks About

Minimum payments are designed to keep you in debt longer, maximizing profits for credit card companies while minimizing your financial progress. Let's explore the true cost of this common practice and how it impacts your long-term financial health.

Frank DiGiacomo