Making minimum payments on credit cards seems harmless—you're meeting your obligations and avoiding late fees. But this seemingly innocent financial habit hides a costly truth that many cardholders fail to recognize until they're trapped in a cycle of debt that can last decades.

Minimum payments are designed to keep you in debt longer, maximizing profits for credit card companies while minimizing your financial progress. Check out this article to go over the history of how credit cards have made historical profits. Let's explore the true cost of this common practice and how it impacts your long-term financial health.

The Mathematics of Minimum Payments

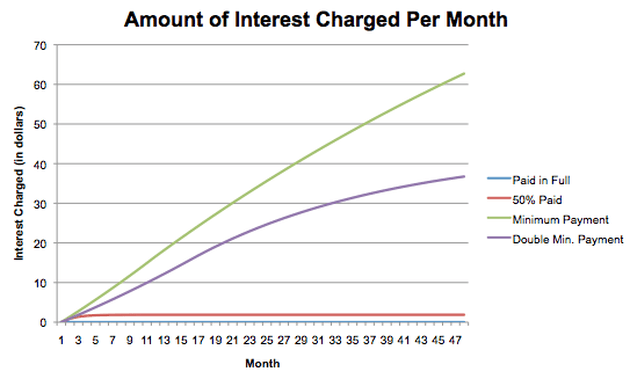

Credit card minimum payments typically range from 1-3% of your balance. This small percentage creates an illusion of affordability while hiding a mathematical reality that works against you.

- For example: On a $5,000 balance with 18% APR and a 2% minimum payment, you'll spend over 30 years repaying the debt and pay nearly $12,000 in interest—more than double the original balance!

According to the Consumer Financial Protection Bureau, this mathematical trap is why they now require credit card statements to show how long it will take to pay off your balance when making only minimum payments.

Minimum payments exploit human psychology in several ways:

- The anchoring effect: By suggesting a low payment amount, card issuers "anchor" your perception of what's appropriate to pay.

- Present bias: We naturally prioritize immediate benefits (keeping more money now) over future costs (paying more interest later).

- The invisibility factor: Interest accumulates silently, making the true cost easy to ignore until it's overwhelming.

Research from behavioral economists at The National Bureau of Economic Research has documented how minimum payment requirements actually decrease the amount consumers choose to pay on their credit cards.

How Credit Card Companies Profit

Credit card issuers aren't offering minimum payments as a courtesy—they're maximizing their profits. When you only make minimum payments, credit card companies earn maximum interest revenue, banks maintain long-term high-interest accounts, and shareholders see increased profits from finance charges.

Meanwhile, your financial progress stalls as interest compounds month after month. The Federal Reserve reports that nearly 40% of Americans wouldn't be able to cover a $400 emergency expense, partly due to existing debt obligations consuming their financial resources.

The Real-Life Impact

The consequences of minimum-payment habits extend beyond your credit card statement:

- Delayed retirement: Money lost to interest could instead be growing in retirement accounts.

- Reduced financial flexibility: High debt payments limit your ability to handle emergencies or opportunities.

- Psychological burden: Living with persistent debt creates stress and anxiety that affects overall wellbeing.

- Opportunity costs: Resources tied up in interest payments can't be used for investments, education, or experiences.

Studies from the American Psychological Association have consistently linked financial stress to negative physical and mental health outcomes, making the hidden costs of minimum payments even more significant.

Breaking Free: Strategies to Escape the Minimum Payment Trap

The good news is that with intentional action, you can break free from the minimum payment cycle:

- Pay More Than the Minimum: Even small additional payments dramatically reduce repayment time and interest costs. Adding just $50 to your minimum payment can cut years off your repayment timeline. The NerdWallet calculator can show you exactly how much time and money you'll save.

- Use the Debt Avalanche Method: Focus extra payments on your highest-interest debt first while maintaining minimum payments on others. This mathematically optimal approach minimizes interest costs. ClearCred offers a good comparison of this method versus alternatives.

- Consider Balance Transfers: Transferring high-interest balances to a card with a 0% introductory APR can provide breathing room to make progress—but only if you have a plan to pay down the balance before the promotional period ends. Bankrate regularly updates lists of the best balance transfer offers.

- Automate Higher Payments: Set up automatic payments above the minimum to ensure consistent progress and remove the monthly decision point that often leads to minimum payments. Most online banking platforms make this easy to set up.

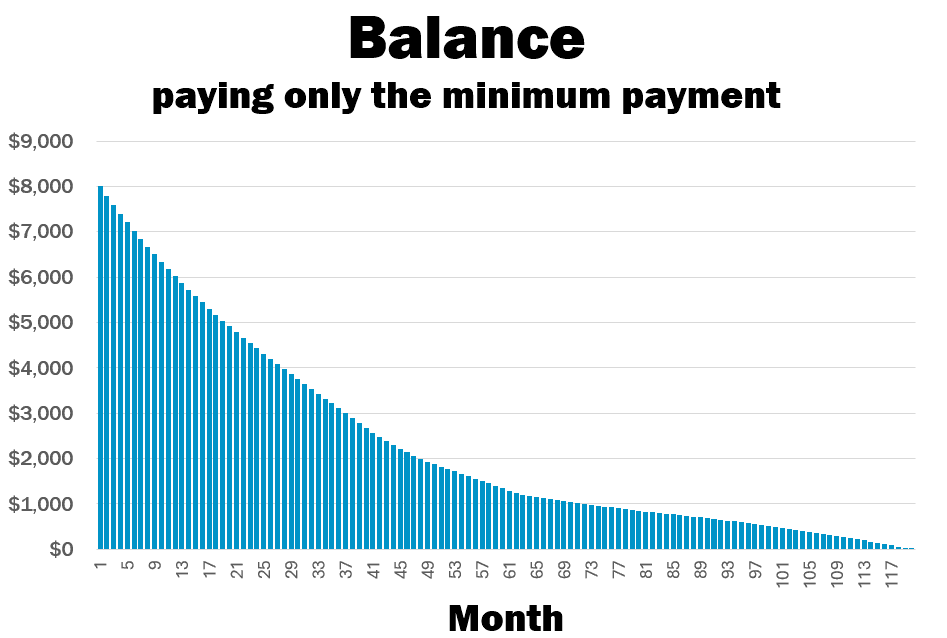

Visualizing Your Debt Freedom

Understanding the impact of paying more than the minimum can be powerful motivation. Here's how different payment amounts affect the same $5,000 balance at 18% APR:

- Paying only the minimum ($100): Takes approximately 30 years to pay off with about $12,000 in interest

- Paying $150 monthly: Reduces payoff time to about 4 years with only $2,200 in interest

- Paying $200 monthly: Further reduces time to about 2.5 years with just $1,300 in interest

- Paying $300 monthly: Achieves debt freedom in roughly 1.5 years with only $750 in interest

Tools like the ClearCred can help you automate your credit card payments in the most optimized way possible. You can choose from more than 4 different paydown methods and store away funds on each credit card purchase.

Conclusion: The Power of Awareness

The minimum payment trap persists because many cardholders don't understand the true cost of this seemingly reasonable practice. By recognizing the mathematics and psychology at play, you can make informed decisions that prioritize your financial future over credit card companies' profits.

Remember: Every dollar paid above the minimum is a step toward financial freedom and represents a significant return on investment through avoided interest. Organizations like Consumer Reports and and of course ClearCred offer additional strategies to accelerate your debt payoff journey.

Continue Reading

Discover more financial insights and tips

Buying vs. Renting in Today's Housing Market: Why Homeownership Prevails

In today's ever-evolving housing market, the age-old debate between buying and renting continues to challenge potential homeowners. While both options have their merits, recent data increasingly supports homeownership as a financially sound decision for many Americans.

Frank DiGiacomo

Navigating the Checkout: "Buy Now, Pay Later" vs. Traditional Credit Cards

Explore the dynamic world of financial flexibility with our latest infographic, where we visually compare the modern convenience of "Buy Now, Pay Later" services against the traditional benefits of credit cards. Dive into an intuitive portrayal of how each option fits into the cyclical nature of spending and payments, symbolized by a credit card's journey around the clock.

Frank DiGiacomo